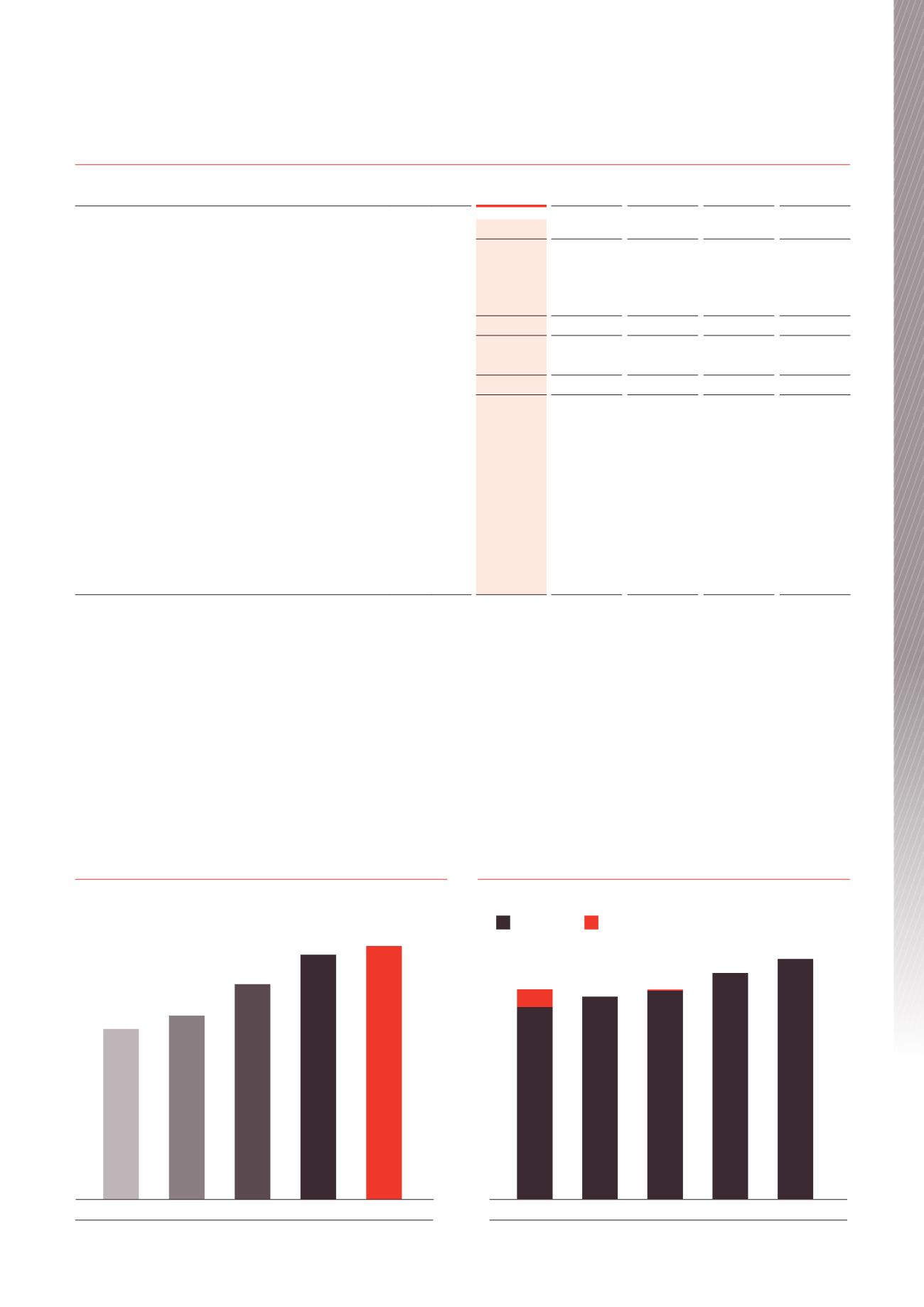

FINANCIAL SUMMARY

Year ended 30 June

2016

2015

2014

2013

2012

Total income

$m

150.2

144.9

127.4

109.2

101.2

Net profit

$m

310.5

210.1

149.1

110.6

69.9

(Gains)/losses in fair value of

investment properties

$m

(202.6)

(108.5)

(57.1)

(34.8)

0.6

Capital profits released fromundistributed income reserve

$m

-

-

0.8

-

6.2

Distributable profit

$m

107.9

101.6

92.8

75.8

76.7

Distribution per ordinary unit

interim cents

8.29

7.67

6.83

7.00

6.63

final cents

8.50

8.17

7.88

7.14

8.04

total cents

16.79

15.84

14.71

14.14

14.67

Tax advantaged component

%

25.44

18.27

14.69

24.26

19.36

Total assets

$m

2,200.5

2,018.0

1,837.4

1,398.7

1,335.2

Borrowings

$m

472.3

485.4

448.3

296.5

288.9

Unitholders’ equity

$m

1,645.4

1,441.8

1,311.4

1,037.2

974.0

Gearing (debt to total assets)

%

21.5

24.1

24.4

21.2

21.6

Number of units on issue

m

642

642

634

538

525

Number of unitholders

24,021

24,374

23,668

18,063

14,924

Net tangible asset backing per unit

$

2.56

2.24

2.07

1.93

1.85

Unit price at 30 June

$

3.64

3.06

2.48

2.25

1.87

Management expense ratio

1

(annualised)

%

0.64

0.65

0.64

0.62

0.58

1

Expenses other than property outgoings and borrowing costs as a percentage of average total assets

Financial performance

Distribution Per Unit (cents)

Total Income ($m)

FY12

Operating profits

FY13

FY14

FY15

FY16

16.79

Capital profits

14.67

14.14

14.71

15.84

FY12

101.2

FY13

109.2

FY14

127.4

FY15

144.9

FY16

150.2

BWP Trust Annual Report 2016

7

Business Review