average price of the Trust’s units for the 20 trading days from and

including 6 July 2016 to 2 August 2016, with no discount applied.

Units to be allocated under the DRPwere acquired on market during

the time and will be transferred to participants on 25 August 2016.

Capital management

The Trust is committed to maintaining a strong investment

grade rating (currently A-/Stable by Standard & Poor’s) through

appropriate capital and balance sheet management.

DEBT FUNDING

The Trust’s debt facilities as at 30 June 2016 are summarised below.

Limit

$m

Amount

drawn

$m

Expiry

date

Bank debt facilities

Australia and New Zealand

Banking Group Limited

110.0

81.4 1 July 2018

Commonwealth Bank of

Australia

110.0

85.2 31 July 2020

Westpac Banking

Corporation

135.0

105.7 30 April 2020

Corporate bonds

Fixed term five-year

corporate bond

200.0

200.0 27 May 2019

Total

555.0

472.3

As at 30 June 2016, the weighted average duration of the Trust’s

debt facilities was 3.2 years to expiry (2015: 4.2 years) and

average utilisation of debt facilities (average borrowings/average

facility limits) for the year was 87.1 per cent (2015: 80.4 per cent).

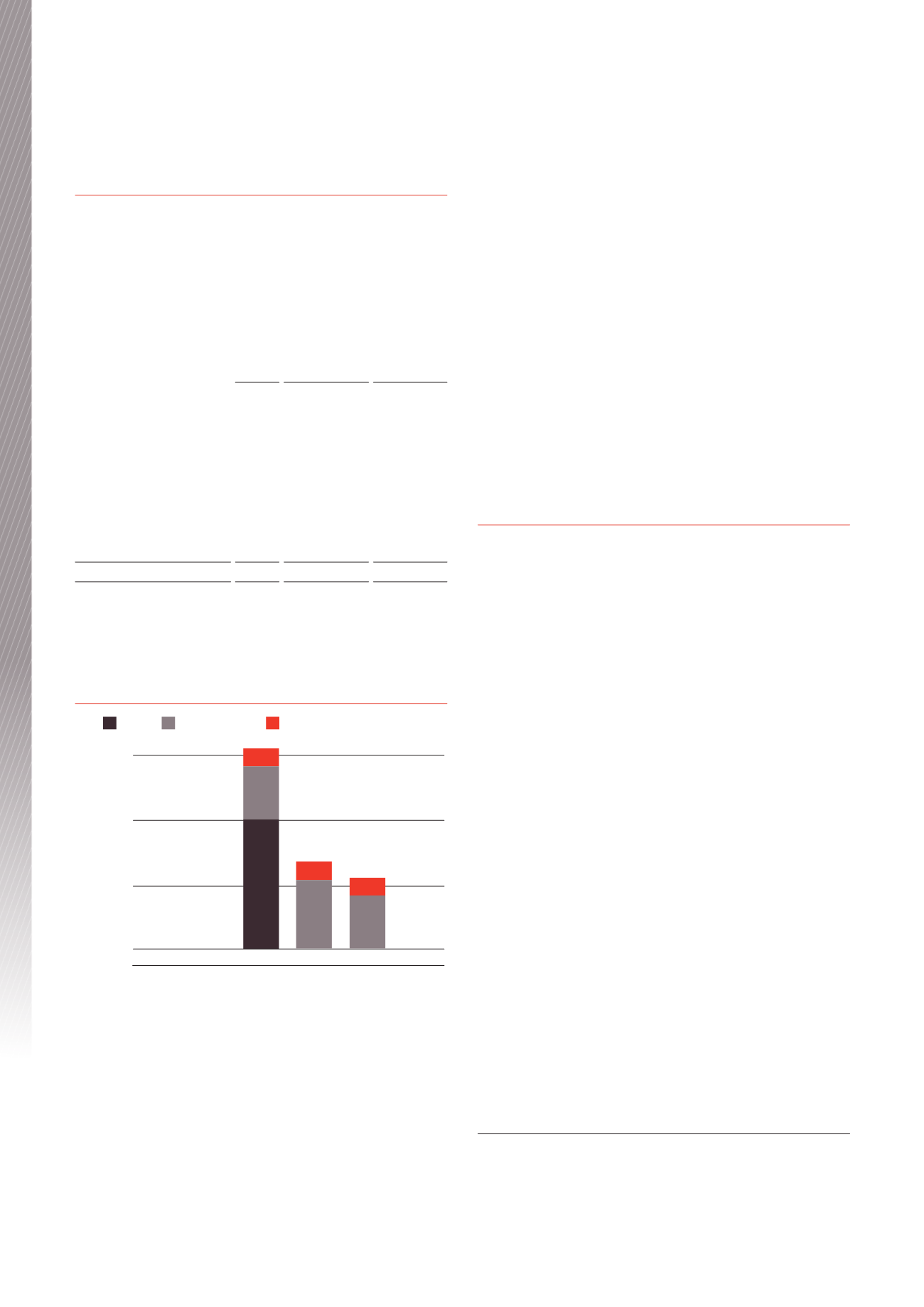

Debt maturity profile

Bonds

Drawn bank facilities

Undrawn bank facilities

FY17

0

100

200

Volume (A$M)

300

FY18 FY19 FY20 FY21

FY22

28.6

81.4

200 29.3

105.7

24.8

85.2

INTEREST RATE RISK MANAGEMENT

The Trust takes out interest rate swaps and fixed rate corporate

bonds (hedging) to create certainty of the interest costs of the

majority of borrowings over the medium to long term. As at 30

June 2016, the Trust’s interest rate hedging cover was 79.4 per cent

of borrowings, with $175.0 million of interest rate swaps and the

$200.0 million fixed rate corporate bond, against interest bearing

debt of $472.3 million. The weighted average term to maturity of

hedging was 2.63 years, including delayed start swaps.

Due to the accounting requirement to mark the value of interest

rate swap hedges to market, the Trust’s hedging liabilities

decreased to approximately $10.0 million as at 30 June 2016

(2015: $10.9 million). The decrease in hedging liability during the

year was due to the reduction in the average term of maturity of the

interest rate swap profile. The hedging liability assesses the potential

liability if all hedges were to be terminated at 30 June 2016.

GEARING

The Trust’s gearing ratio (debt to total assets) at 30 June 2016 was

21.5 per cent (2015: 24.1 per cent), which is at the lower end of the

Board’s preferred range of 20 to 30 per cent. This should allow the

Trust to take advantage of opportunities to create long term value

when they arise. The interest cover ratio (earnings before interest

and tax/interest expense) was 5.6 times (2015: 5.1 times).

DISTRIBUTION REINVESTMENT PLAN

The DRPwas in place for both the interim distribution and final

distribution for the year ended 30 June 2016. The Trust has

continued to maintain an active DRP as a component of longer-term

capital management and to allow unitholders flexibility in receiving

their distribution entitlements. The DRP provides a measured and

efficient means of accessing additional equity capital from existing

eligible unitholders when required.

Operating environment

BUNNINGS – THE TRUST’S KEY CUSTOMER CONTRIBUTING

93 PER CENT OF RENTAL INCOME

Bunnings is the leading retailer of home improvement and outdoor

living products in Australia and New Zealand and a major supplier to

project builders, commercial tradespeople and the housing industry.

As at June 2016, Bunnings had a network of 240 Bunnings

Warehouse stores across Australia and New Zealand, around 70

smaller format stores and 33 trade centres

1

.

As at 30 June, 2016, approximately 93 per cent of the Trust’s

annual rental income is from Bunnings and therefore the Trust’s

earnings are linked to the ongoing success of the Bunnings business

and the strength and direction of the underlying home improvement

and outdoor living markets.

For the financial year ended 30 June 2015, Bunnings reported

revenue of $9.534 billion and EBIT of $1.088 billion

2

. In the period

from 30 June 1995 to 30 June 2015, Bunnings grew sales and

earnings before interest and tax (“EBIT”) at a compound annual

growth rate of 16.1 per cent per annum and 20.3 per cent per

annum, respectively

3

.

For the nine month period ended 31 March 2016, Bunnings

reported sales of $8.09 billion, up 10.9 per cent on the previous

corresponding period

4

.

At the recent Wesfarmers Strategy Briefing Day, Bunnings

re-confirmed its strong focus on long termvalue creation through

a winning offer to customers, an engaged, focused and committed

team, business behaviour that builds trust, and sustainable returns

5

.

Bunnings presented its 2016/17 strategic agenda with a focus on

creating better customer experiences, strengthening the core of

1

Source: Wesfarmers Strategy Briefing Day, 22 June 2016, page 59

2

Source: Wesfarmers 2015 full-year results announcement, 20 August 2015,

page 9

3

Source: Wesfarmers Strategy Briefing Day, 22 June 2016, page 37

4

Source: Wesfarmers third quarter results announcement, 21 April 2016, page 1

5

Source: Wesfarmers Strategy Briefing Day, 22 June 2016, page 36

BWP Trust Annual Report 2016

10

Business Review