17. DIRECTOR AND EXECUTIVE DISCLOSURES

(CONTINUED)

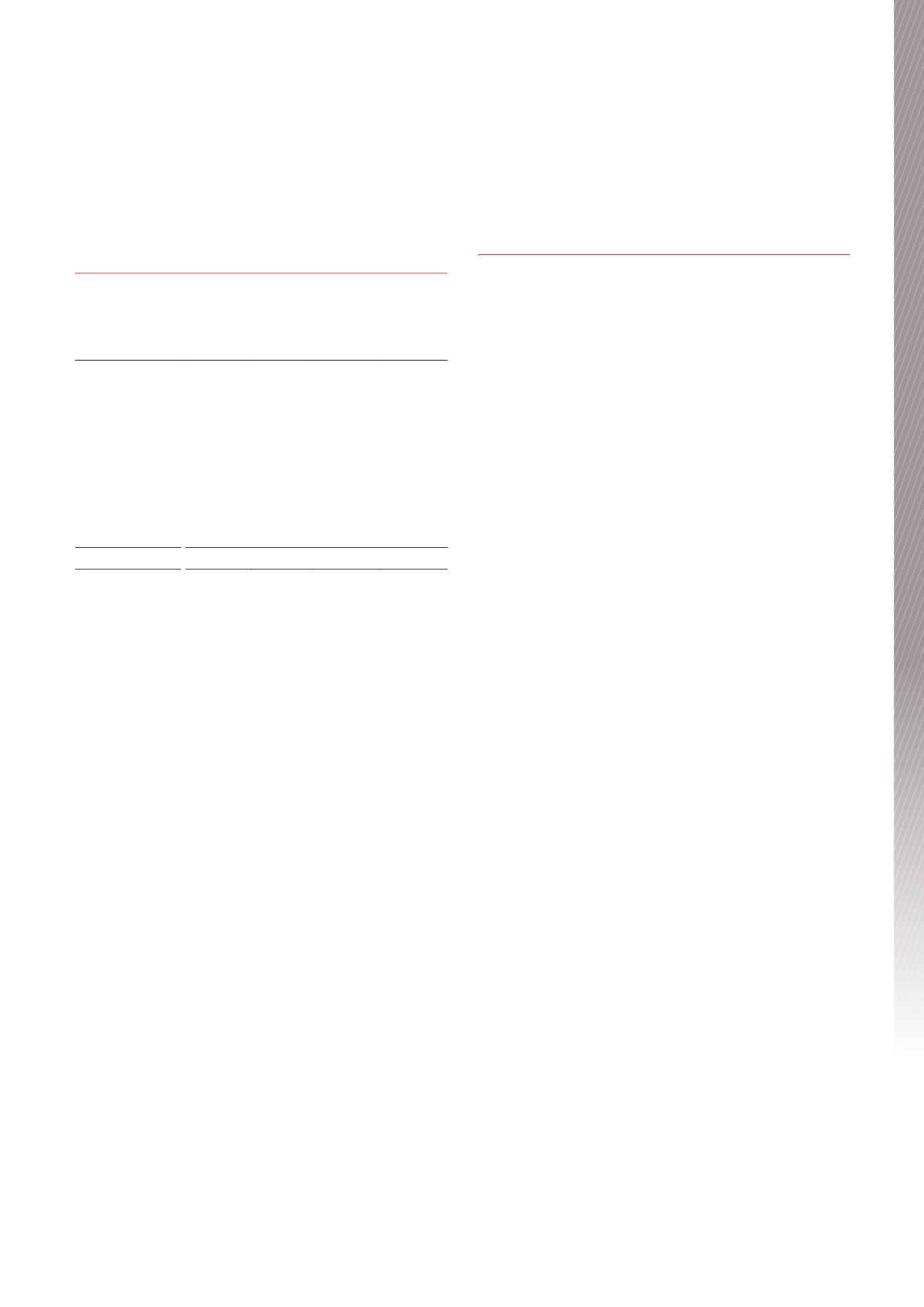

(c) Unit holdings

Director

Balance at

beginning

of the year

Acquired

during the

year

Sold

during the

year

Balance at

the end of

the year

Mr J K Atkins

1

26,501

- (26,501)

1

-

Mr J A Austin

1

343,859

- (343,859)

1

-

Mr E Fraunschiel

111,766

-

-

111,766

Ms F E Harris

20,000

-

-

20,000

Mr R D Higgins

20,000

-

-

20,000

Mr A J Howarth

20,000

-

-

20,000

Mr M J G Steur

-

-

-

-

Mr M J Wedgwood

-

-

-

-

Total

542,126

- (370,360)

171,766

1

Ceased to be non-executive director during the year

The above holdings represent holdings where the directors have a

beneficial interest in the units of the Trust.

No directors have other rights or options over interests in the Trust or

contracts to which the director is a party or under which the director

is entitled to a benefit and that confer a right to call for or deliver an

interest in the Trust.

18. OTHER ACCOUNTING POLICIES

a) Impairment

A financial asset is assessed at each reporting date to determine

whether there is any objective evidence that it is impaired. A financial

asset is considered to be impaired if objective evidence indicates that

one or more events have had a negative effect on the estimated future

cash flows of that asset.

An impairment loss in respect of a financial asset measured at

amortised cost is calculated as the difference between its carrying

amount and the present value of the estimated future cash flows

discounted at the original effective interest rate.

Individually significant financial assets are tested for impairment

on an individual basis. The remaining financial assets are assessed

collectively in groups that share similar credit risk characteristics.

In circumstances where impairment losses are deemed, these are

included in the statement of profit or loss and other comprehensive

income.

b) Goods and Services Tax

Revenues, expenses and assets are recognised net of the amount of

Goods and Services Tax (“GST”) except where the GST incurred on a

purchase of goods and services is not recoverable from the taxation

authority. In these circumstances the GST is recognised as part of

the cost of the acquisition of the asset or as part of the expense.

Receivables and payables are stated with the amount of GST

included. The net amount of GST recoverable from or payable to the

taxation authority is included as part of receivables or payables in

the statement of financial position.

Cash flows are included in the statement of cashflows on a gross

basis and the GST component of cash flows arising from investing

and financing activities, which is recoverable from, or payable to, the

taxation authority, are classified as operating cashflows.

Commitments and contingencies are disclosed net of the amount of

GST recoverable from, or payable to, the taxation authority.

BWP Trust Annual Report 2016

45

Financial Report